9 Simple Techniques For Guided Wealth Management

Wiki Article

Some Of Guided Wealth Management

Table of ContentsThe Facts About Guided Wealth Management Uncovered4 Easy Facts About Guided Wealth Management DescribedSome Known Details About Guided Wealth Management Get This Report about Guided Wealth Management

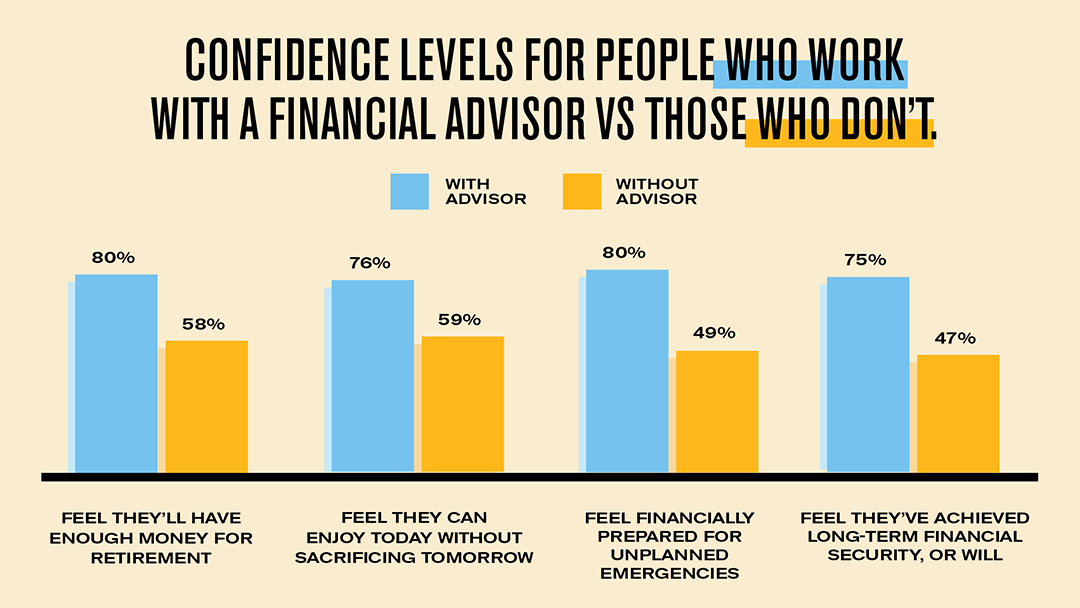

Retirement planning has actually never ever been more facility. With modifications in tax regulations and pension plan policy, and hopefully a lengthy retired life ahead, individuals coming close to completion of their jobs need to navigate an increasingly tough backdrop to ensure their economic needs will be met when they retire. Include an unpredictable macroeconomic atmosphere, and the danger of not having a clear strategy can have a severe effect on retired life quality and way of living options.Looking for monetary advice is a good concept, as it can aid individuals to enjoy a hassle-free retirement. Below are 5 ways that people can gain from engaging with a professional financial advisor. Dealing with an adviser can assist people to draw up their retired life objectives and guarantee they have the appropriate plan in place to fulfill those objectives.

"Inheritance tax obligation is a complex area," claims Nobbs. "There are many ways to manoeuvre via inheritance tax preparation as there are a range of products that can help alleviate or lower inheritance tax obligation.

Fascination About Guided Wealth Management

"It can be really hard to talk with your family about this because as a culture we do not like speaking about cash and fatality," states Liston. "There's so much you can do around legacy, around gifting and around count on preparation. I fret that so much of society doesn't recognize concerning that, allow alone have access to it." If you're not using a consultant, just how do you manage your investments and how do you recognize you've picked the best products for you? While on-line services make it much easier for clients to view their items and performance, having a consultant handy can help clients understand the alternatives available to them and lower the admin worry of handling products, permitting them to concentrate on appreciating their retirement.Retirement preparation is not a one-off occasion, either. With the appeal of earnings drawdown, "investment does not quit at retirement, so you require a component of knowledge to recognize exactly how to obtain the best blend and the ideal equilibrium in your investment remedies," claims Liston.

The Facts About Guided Wealth Management Revealed

For circumstances, Nobbs had the ability to help one of his clients move cash right into a variety of tax-efficient products to ensure that she could attract a revenue and would not need to pay any type of tax until she had to do with 88. "They live conveniently currently and her other half was able to take layoff as a result," he states."Individuals can come to be really worried about how they will fund their retired life since they do not understand what setting they'll be in, so it pays to have a conversation with a financial consultant," states Nobbs. While saving is one noticeable advantage, the worth of suggestions runs much deeper. "It's all concerning giving individuals comfort, recognizing their requirements and helping them live the lifestyle and the retirement they desire and to look after their family if anything should happen," states Liston.

Looking for economic suggestions may appear overwhelming. In the UK, that is fuelling an expanding suggestions void just 11% of grownups surveyed said they would certainly paid for monetary advice in the previous two years, according to Lang Pet cat research study.

The Ultimate Guide To Guided Wealth Management

"The world of monetary advice in the UK is our heartland," claims Liston. M&G Wealth Advice makes economic recommendations much more accessible for more individuals.They specialise in advising products from Prudential and various other meticulously selected partners. This is referred to as a limited recommendations service.

It's not simply about preparing for the future either (financial advisor redcliffe). A financial adviser can aid change your existing circumstance as well as preparing you and your family for the years ahead. A monetary adviser can assist you with methods to: Pay off your mortgage quicker Save money and grow your properties Increase your super equilibrium with tax-effective approaches Shield your revenue Build an investment profile Offer your children a running start and aid them secure their future Like any kind of trip, when it comes to your funds, preparation is the key

Report this wiki page